The resolution of the TEAC of September 24, 2024 resorts to the hackneyed (and often used and stretched to the point of prevarication) tool of transfer pricing in the context of related-party transactions to once again provide us with an example of creativity.

The inspection had understood that a director of company A, who in turn represented the company on the board of directors of two of its subsidiaries, should be paid an amount in addition to his salary for this function.

The resolution of the TEAC (which, by the way, amends a previous resolution of the TEAR that had ruled in favor of the taxpayer) establishes that the members of the board of directors of a company, including the CEO, must receive, apart from their salary for the position they hold, any representation function they exercise in any other company linked to the one they manage. Otherwise, the Tax Agency will consider that a remuneration is being hidden to avoid paying personal income tax, by pretending that this function is already paid as part of the salary as a director.

In the specific case, the director of company A had received this specific remuneration in previous years, but a reorganization of his functions and position caused him to stop receiving it. This circumstance caused the inspection to deny the company the possibility of organizing (and financing) its resources within the entrepreneurial freedom guaranteed by the Constitution, in order to understand that its functions had not been “valued at market value” and that it should be taxed on the remuneration it had stopped receiving.

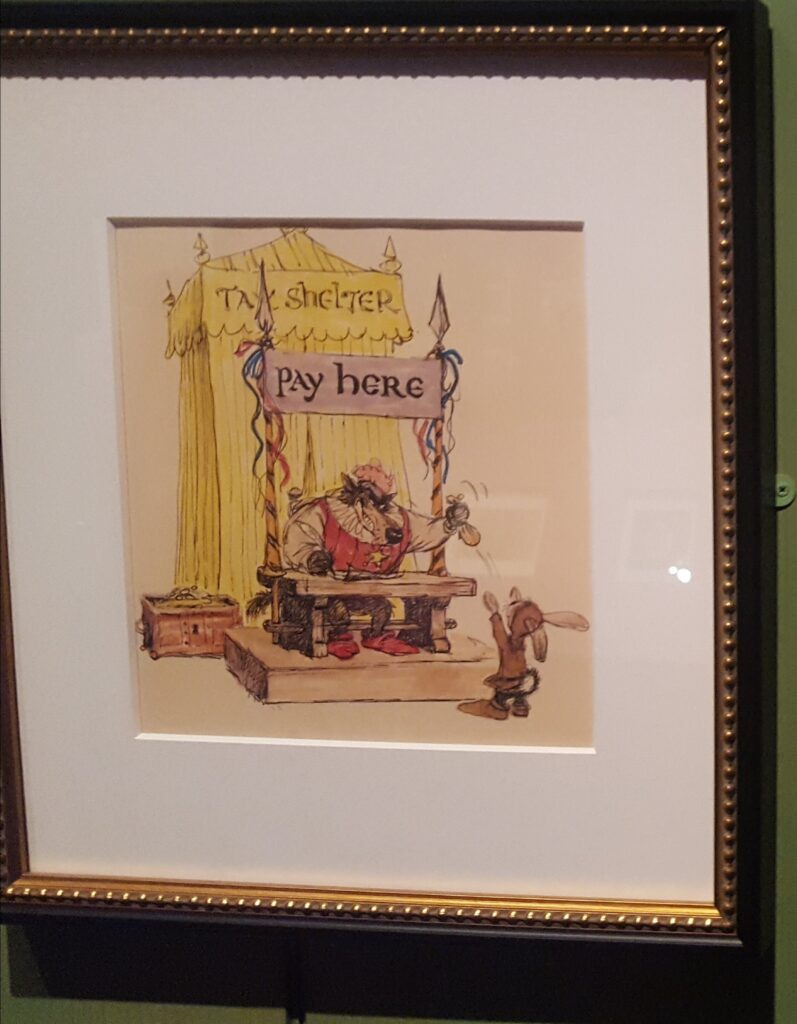

In short, more wood, if there is no income to tax, I invent it.